Structured Solutions

Structured Solutions offers bespoke Property and Casualty insurance solutions providing stable and comprehensive coverage over a multi-year period.

Three Powerful Reasons to Consider a Structured Solution

- Customized Coverage

Property, Excess Liability, and Excess Auto Liability

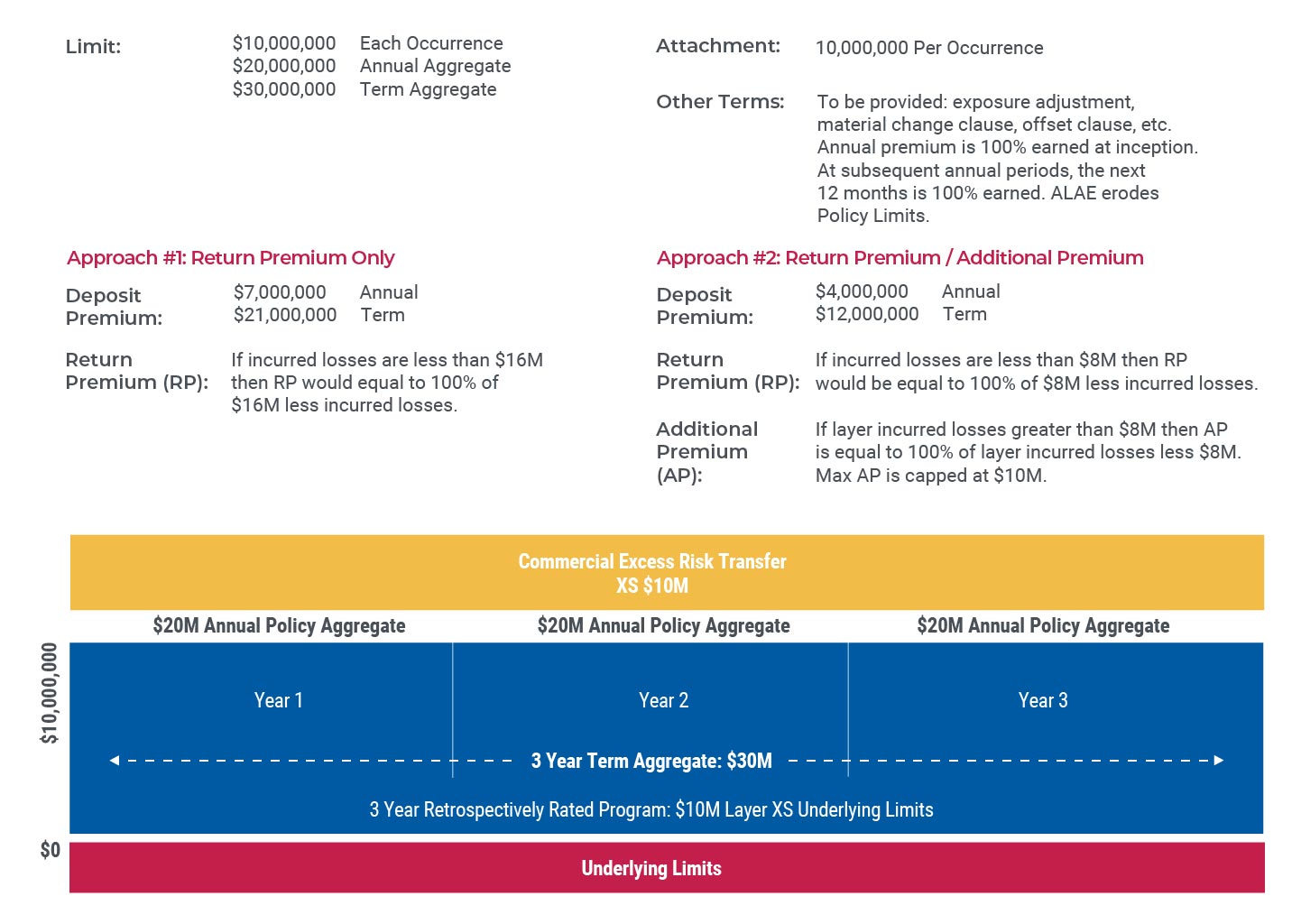

The Structured Solutions team works with the retail broker and insured to tailor a program to meet the insured’s specific insurance needs, including integrating other alternative risk products. Insureds can benefit from the risk / reward structures of a program. We have a broad risk appetite and coverage platform with significant capacity with defined Occurrence / Accident Limits, Annual Limits and Term Limits. Flexible deployment of capacity within an insured’s tower. - Cost Certainty

Together, we will evaluate risk appetite, coverage and financial needs, as well as develop a longer-term commitment (2-3 years) that provides stability and predictability in insurance costs. By locking in insurance rates, insureds have cost certainty and protection against potential premium increases due to market fluctuations. - Cash Flow Flexibility

Multi-year structured programs may offer various premium payment options, allowing the insured a variety of ways to spread insurance costs over the multi-year period. Financially strong insureds may be able to pay less premium up front with a requirement to pay additional premiums if losses exceed a certain threshold. Programs may also be developed with return premiums to benefit insureds with favorable loss experience.

Sample Illustration: 3 Year Policy Term

Contacts

| Jay Peichel | jay.peichel@keystonerisk.com | 610-952-5699 |

|---|